What Is Accrual Accounting? Importance, Challenges, and Benefits

Shweta Singh

October 30, 2024 10 Min Read

See Savant AI Agents turn unstructured data into usable insights — live.

Register

AI and Automation Are Reshaping Finance, Tax, and Accounting — See How.

Download Now

Unstructured data slows finance and analytics. Watch the fix in our Fall Release webinar.

Save Your Spot

Accrual accounting has become an indispensable component of modern financial management. It offers a detailed and real-time representation of a company’s financial status, instilling confidence.

Unlike cash accounting, which recognizes transactions only when money changes hands, accrual accounting captures the essence of business activities as they unfold, regardless of when cash transactions occur.

Aligning with the economic reality of business operations provides a detailed, real-time view of an organization’s financial health. These insights empower decision makers with the information they need to steer the company in the right direction.

Accrual accounting is the practice of recording revenues and expenses when they are earned or incurred, not necessarily when cash is received or paid. This method is grounded in two fundamental principles: the matching principle and the revenue recognition principle.

The matching principle ensures that expenses are recognized in the same period as the revenues they helped generate, offering a synchronized view of financial performance.

Meanwhile, the revenue recognition principle dictates that revenue is recorded when earned, regardless of when the payment is received. Together, these principles guarantee that the financial statements accurately and consistently portray a company’s financial standing.

Consider a scenario where a consulting firm provides services in January but does not receive payment until March. Under accrual accounting, the revenue is recorded in January, the month when the service was provided, not in March, when the payment is received. Similarly, if the firm incurs an expense in March but pays for it in April, it is recorded in March.

An approach like this captures the true economic activity of the business, offering insights that would be obscured under cash accounting.

Accrual accounting’s importance cannot be overstated, particularly for businesses that engage in complex transactions, long-term contracts, or credit sales. It supports better decision making, enhances transparency, and guarantees compliance with regulatory standards, providing a more accurate representation of financial performance.

Accrual accounting is particularly valuable in industries where transactions do not immediately result in cash exchange, for instance, in construction, where projects may span several years, or in retail, where sales may be made on credit. In these cases, accrual accounting allows companies to recognize revenues and expenses as they are earned or incurred, rather than waiting for cash transactions.

Accrual accounting is a requirement under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), which govern financial reporting for publicly traded companies.

GAAP is a set of rules related to accounting, processes, and standards issued and regularly revised by the FASB or Financial Accounting Standards Board, generally followed in the US. IFRS is also a set of accounting rules that ensures the consistency, transparency, and comparability of financial statements of public companies, followed in the EU.

Accrual accounting revolves around two primary categories: accrued revenues and accrued expenses. Understanding these helps grasp the full scope of this accounting method.

It is important to recognize revenues and expenses as they occur, as it helps businesses ensure that their financial statements reflect the true state of their operations rather than just the timing of cash transactions.

Implementing accrual accounting requires a systematic approach to recording financial transactions.

Accrual accounting offers numerous advantages, making it the preferred method for most businesses, particularly those with complex financial transactions or long-term contracts.

While accrual accounting accurately represents a company’s financial position, cash accounting is much more straightforward. The primary distinction between the two approaches is the point at which transactions are documented.

The cash accounting method only documents transactions when cash is received or disbursed. It is simple and easier to manage, particularly for small businesses or individuals with limited transactions. However, this approach fails to reflect a company’s financial status, as it overlooks receivables, payables, and other non-cash activities.

Conversely, accrual accounting records transactions at the moment they occur, irrespective of when the cash flow happens. This method offers a more accurate and comprehensive view of a company’s financial position, making it the preferred choice for larger businesses, particularly those that must comply with GAAP or IFRS.

A company using cash accounting might appear profitable if it receives a large payment at the end of the year, even if it has significant unpaid bills. In contrast, accrual accounting would show a more accurate picture by recording both the revenue and the expenses in the period they were incurred, providing a clearer view of the company’s financial health.

Despite its advantages, accrual accounting presents several challenges businesses must address to enable accurate financial reporting.

Despite these challenges, accrual accounting’s strategic importance in business operations and financial management is undeniable. It provides the most accurate and timely insight into financial performance for businesses that operate on credit or have long-term contracts.

Accrual accounting supports better long-term financial planning. Businesses can make more informed decisions about resource allocation, investment opportunities, and growth strategies with a detailed and accurate picture of expected revenues and expenses.

Accrual accounting also enhances budgeting and performance evaluation. Aligning financial reporting with the actual timing of revenues and expenses allows businesses to more accurately assess their performance against budgets and financial targets.

And, of course, as we’ve already seen, accrual accounting is integral to regulatory compliance. As required by GAAP and IFRS, accrual accounting makes sure that businesses meet regulatory bodies’ financial reporting requirements.

Accrual accounting is more than just an accounting method — it is a strategic tool that provides a comprehensive and accurate representation of a company’s financial health, providing essential insights for informed decision making and strategic planning.

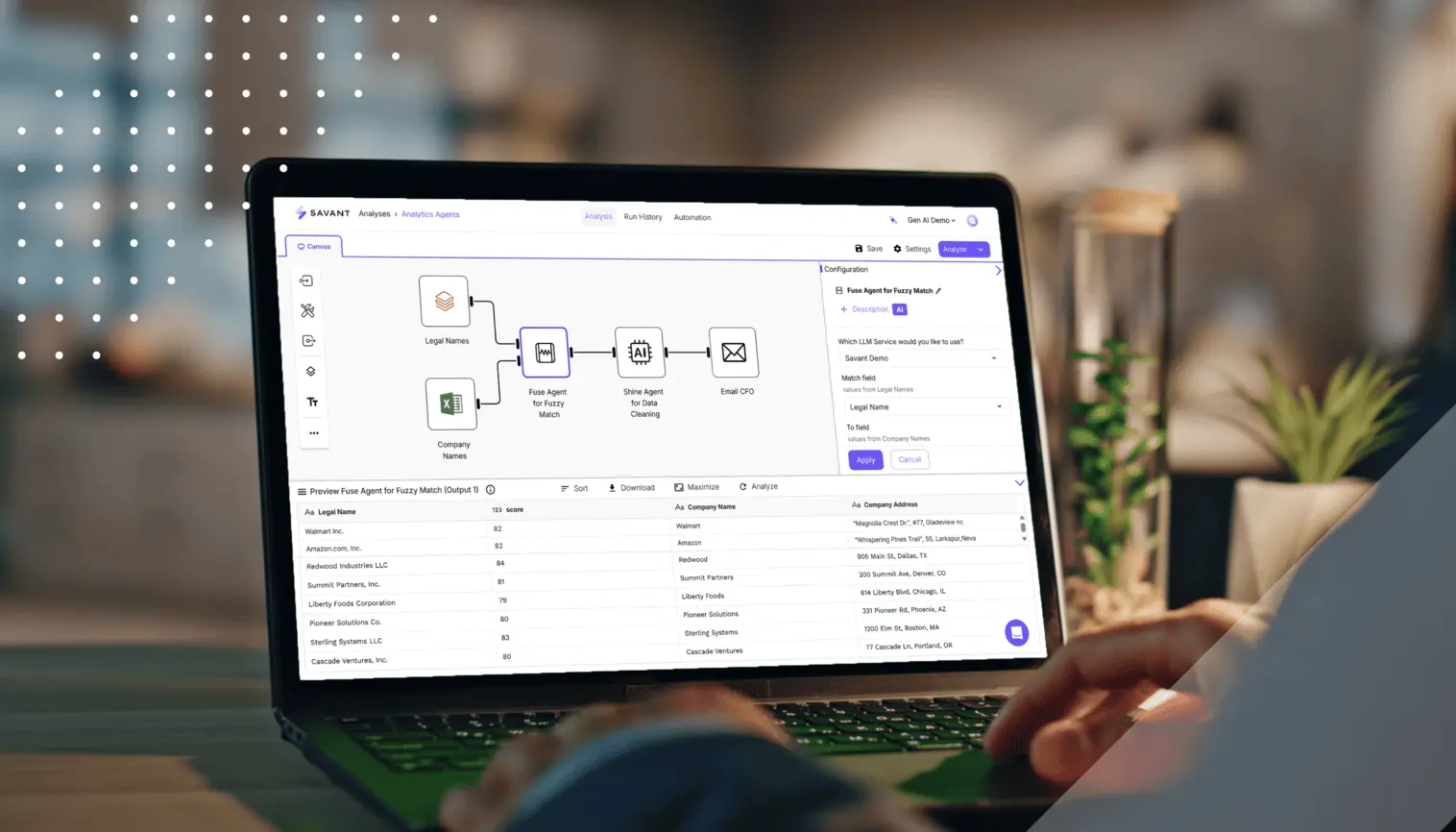

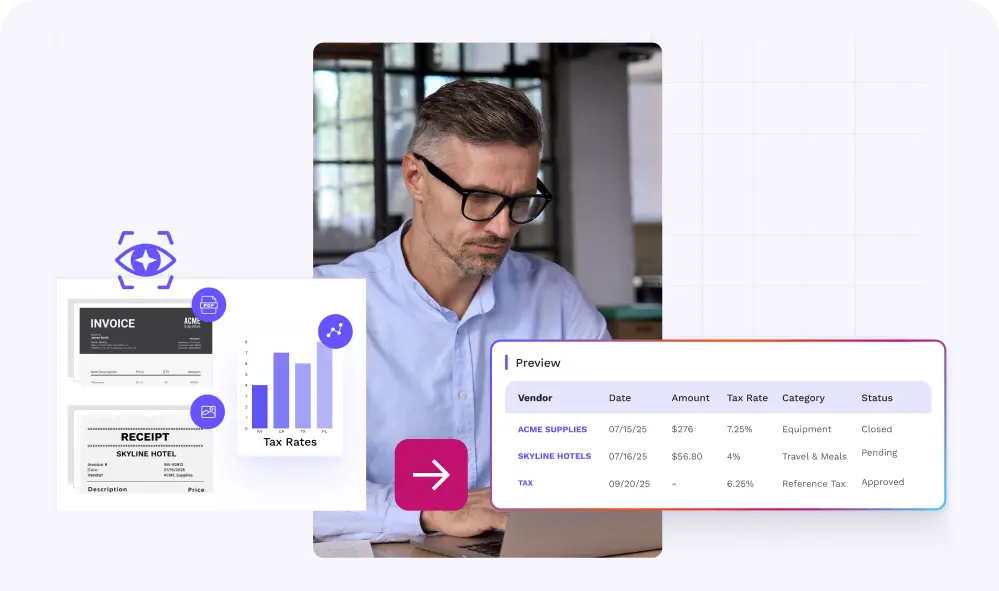

However, the complexity and effort required to manage accrual accounting can be a challenge, particularly for businesses with intricate financial transactions and large data volumes. This is where Savant becomes an invaluable partner. Its automation capabilities extend beyond just data handling.

Savant integrates with over 200 data sources and delivers insights across various business applications, enabling organizations to optimize their accrual accounting processes, free up resources, reduce errors, and accelerate financial reporting.

Savant transforms accrual accounting from a complex, time-consuming task into a streamlined, efficient process, allowing businesses to focus on what truly matters: driving growth and success. Experience how Savant can elevate your financial management process and empower your business with actionable insights with a free trial.