How To Close the Books Faster With Automated Workflows

Shweta Singh

September 26, 2025 8 Min Read

See Savant AI Agents turn unstructured data into usable insights — live.

Register

AI and Automation Are Reshaping Finance, Tax, and Accounting — See How.

Download Now

Unstructured data slows finance and analytics. Watch the fix in our Fall Release webinar.

Save Your Spot

Month-end shouldn’t feel like a fire drill. Yet, when the calendar flips, finance teams often face manual handoffs, scattered data, and late surprises. Widespread disruption to accountants’ personal time and frequent reopenings of the books to fix errors are the norm — symptoms of a process that relies on people stitching together systems under a deadline. Leadership waits while the books remain open, and decisions stall behind reconciliations.

Automation changes the cadence. The goal isn’t to replace judgment, but to eliminate the repetitive steps that slow teams down, allowing reviewers to spend time on exceptions rather than assembly. With the right workflows, month-end shifts from a stress test to a routine wherein numbers land earlier, reviews are calmer, and finance has room for forward-looking work.

The close is the process that locks in the financial story for the period. Transactions post, cash and subledgers tie to the general ledger, and adjustments account for timing items like accruals and payroll. Once reconciled and approved, leaders can rely on the results. On paper, the sequence is simple; in practice, inputs arrive at different speeds, teams are distributed, and approvals queue up in inboxes. A five-to-seven-day plan turns into something longer as late journals or vendor invoices trigger another pass.

When the close drags, the ripple effects are immediate. Leaders make calls on outdated numbers and defer moves until reports are final. Compliance deadlines tighten, rework creeps in, and the pressure to ship invites mistakes. Regulated companies feel this acutely because delays increase audit and disclosure risk. Internally, recurring late nights burn out teams and strain collaboration as functions operate on different versions of the truth. The longer the books stay open, the slower the business moves.

Most delays trace back to a few repeatable issues. Fixing these doesn’t require reinvention — just clear ownership and workflows that move work continuously instead of in end-of-week batches. Start by naming the patterns below in your own process.

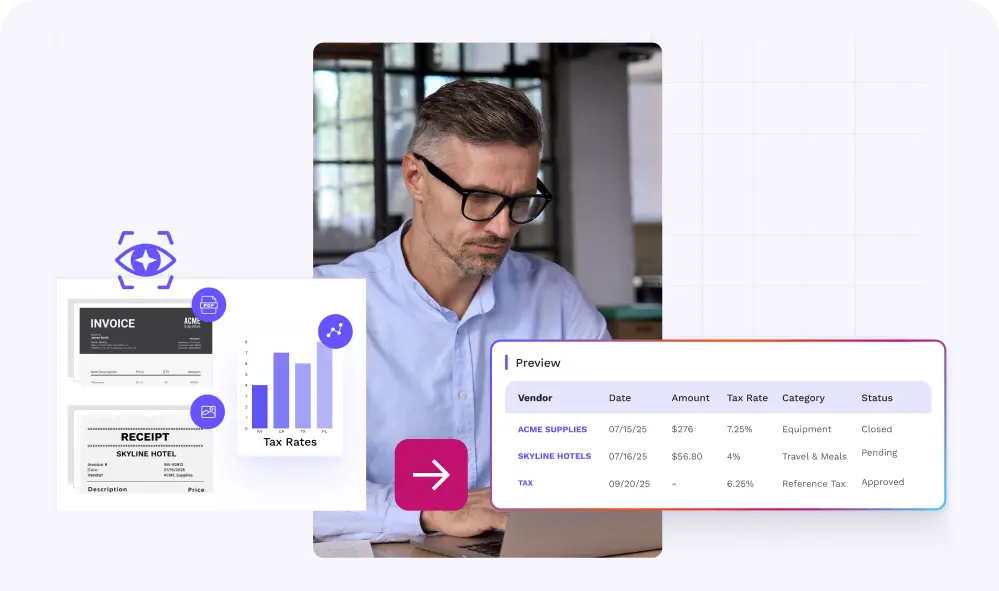

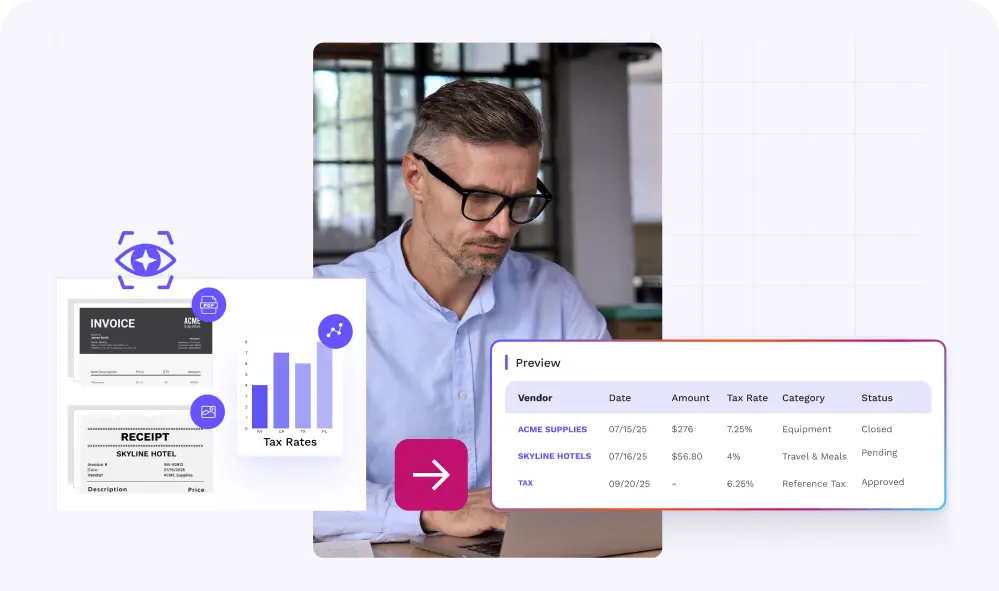

Automation won’t “do the close” for you, but it can remove the grind. Reconciliations no longer need line-by-line matching; the system clears routine items and queues the exceptions with context. Recurring journal entries draft themselves based on rules, so reviewers spend time on judgment, not data entry.

The bigger shift is visibility. Automated workflows expose status without email chains: a dashboard shows what’s complete, what’s in review, and what’s blocked. That transparency reduces follow-ups, shortens handoffs, and keeps the whole team working from the same reality.

The value isn’t only speed; it’s a steadier, more reliable close.

Not everything in the close is worth automating. But there are a few spots every finance team complains about — where the friction is obvious and repetitive — and they’re usually the best place to start. Quick wins build trust in the new process.

Here’s what that looks like in practice. A mid-stage SaaS company ran close tasks via email and shared sheets. Ownership was unclear, reminders were manual, and late items surfaced at the last minute. After moving to an automated checklist, every task had a named owner and deadline, reminders and escalations happened automatically, and leadership could track progress in real time. The team spent less time chasing status and more time resolving the few items that actually needed judgment.

Step 1: Define the goal and map the process

Agree on what “faster” means (e.g., five-day close, no after-hours work). Diagram the end-to-end flow from cut-off to final report. List each task, owner, system, inputs/outputs, and current SLAs. This makes bottlenecks and repeatable tasks visible.

Step 2: Choose high-impact starting points

Prioritize repetitive, rules-based, time-consuming work. Typical first wins: bank and GL reconciliations, recurring journal entries, expense approvals, and close-checklist tracking. These automate cleanly and show results quickly.

Step 3: Prepare your data and systems

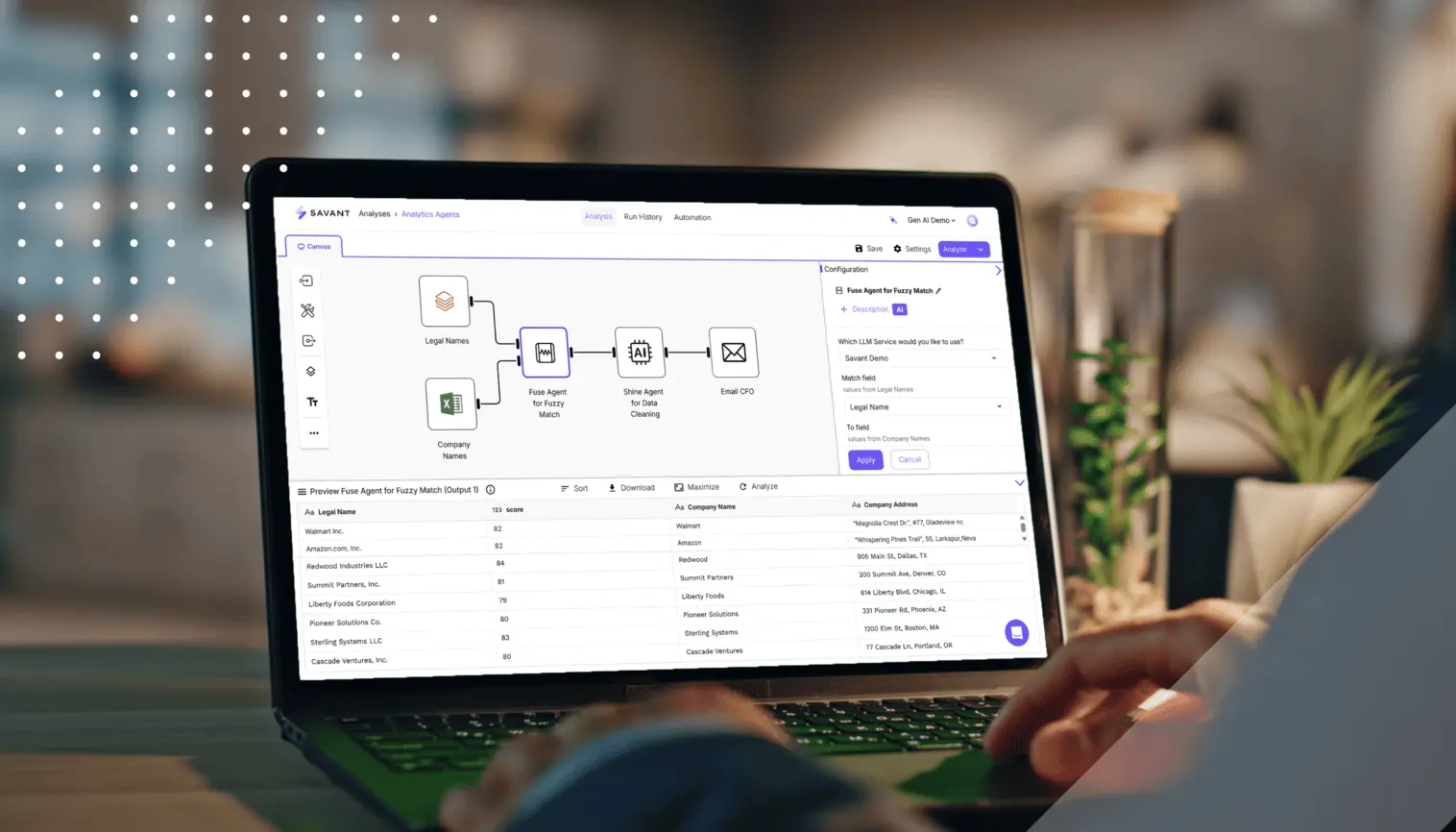

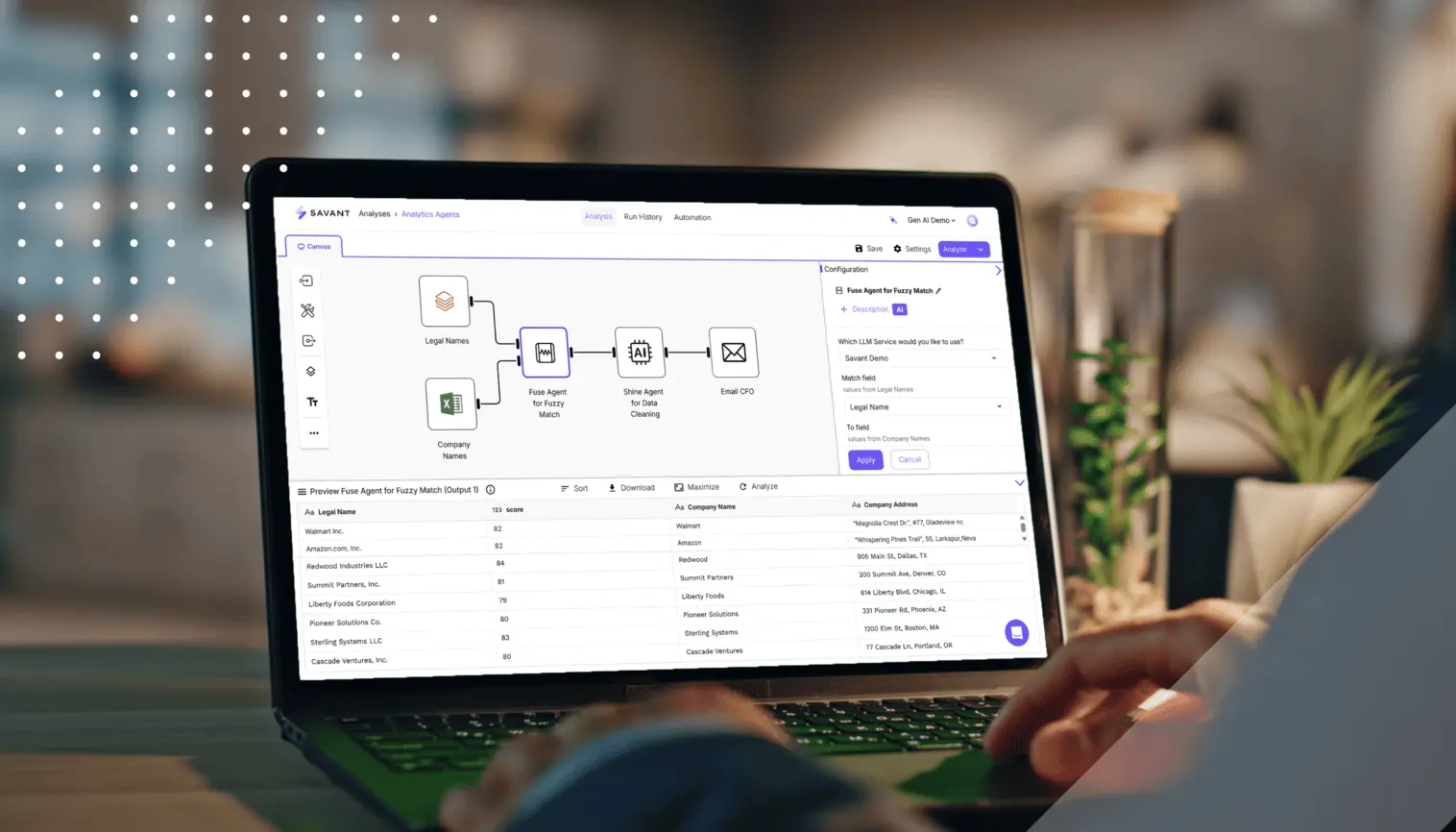

Automation needs clean, connected data. Standardize chart-of-accounts mappings and cost-center codes. Confirm integrations for ERP, bank feeds, and expense tools. Platforms like Savant centralize these connections and keep feeds current on an automated schedule.

Step 4: Build and pilot the workflow

Start with one workflow (e.g., bank recs). Define auto-match rules and review thresholds; run the automated flow in parallel for one cycle. Track metrics such as percent auto-matched, exceptions per 1,000 lines, and hours saved. Savant can route exceptions to the right owner and surface resolution times on a dashboard, which highlights bottlenecks.

Step 5: Roll out and expand

If the pilot meets targets, extend it to more entities and add the next workflow . Scale stepwise to keep adoption high and disruption low. Savant’s dashboards show cycle time trends, queue backlogs, and evidence completeness as you expand.

Automation introduces its own set of considerations. The antidote is proactive change management: clear communication about the benefits, data cleanup before implementation, and a thoughtful rollout plan.

Plan the change: communicate early, fix data basics first, and phase releases with visible wins.

Savant is a cloud-native finance automation platform that connects your ERP, bank feeds, payroll, and expense systems; orchestrates close workflows end to end; and preserves an audit-ready trail as work happens. It centralizes data, automates reconciliations and recurring entries, routes approvals, and gives leaders live visibility into progress, so that the close runs on rails instead of email threads.

Here’s what you get with Savant:

The close won’t vanish, but the anxiety can. Map your current process, automate one high-impact workflow, and measure the result. That first win builds momentum for broader change. As the cadence improves, finance moves from reactive firefighting to proactive guidance; leaders get fresher numbers, decisions land sooner, and your team spends more time on analysis than assembly. That shift is a competitive edge.