Top 10 Tax Consulting Firms in 2025

Joseph Jacob

October 8, 2025 11 Min Read

See Savant AI Agents turn unstructured data into usable insights — live.

Register

AI and Automation Are Reshaping Finance, Tax, and Accounting — See How.

Download Now

Unstructured data slows finance and analytics. Watch the fix in our Fall Release webinar.

Save Your Spot

Taxes in 2025 aren’t a once-a-year chore. It’s a real-time control environment. The 15% global minimum under OECD Pillar Two began applying from 2024, so top-up calculations are no longer hypothetical. At the same time, e-invoicing and continuous transaction controls have gone mainstream, with over 80 countries now mandating some form of e-invoicing or e-reporting, often in real or near-real time.

In this complex environment, choosing a tax adviser is a strategic risk decision. The cost of getting it wrong shows up as penalties, late top-ups, restatements, and avoidable blind spots in digital reporting.

Picture quarter-end: schemas change, invoicing windows close, and your effective tax rate flashes red when a low-tax entity drags the group below 15%. Most in-house teams don’t have the spare capacity or the data plumbing to chase every moving target. That’s why specialized firms have shifted from “nice to have” to essential partners.

Recent surveys show transparency and digitalization are the dominant themes for tax leaders in 2024–2025, with 82% expecting more public tax disclosure in the next two to three years. The signal is clear: Policy complexity is rising, and reporting is getting faster and more granular.

Why bring in outside help? Because modern compliance is half policy mastery and half data engineering. The best teams can parse a draft decree and stand up the data pipelines that feed Pillar Two and e-reporting models on short notice.

Pillar Two cash calls are here. The global minimum regime started to apply from 2024, which means many groups are calculating and paying top-up taxes now, with broader rules (like UTPR) following from 2025. CFOs need daily visibility into ETR swings, not end-of-quarter surprises.

Digital reporting moved to (near) real time. Dozens of jurisdictions now require e-invoices or invoice data to be validated or reported as transactions occur. Manual reconciliations simply cannot keep pace with continuous transaction controls (CTC) systems.

AI crossed the adoption tipping point. With ~42% of enterprises already deploying AI and ~40% experimenting, competitors are automating data pulls, reconciliations, and scenario modeling while late adopters are stuck fighting spreadsheets.

Add it all up, and 2025 forces three hard questions for CFOs and Heads of Tax:

If the answer to any one of these questions is “not yet,” outside help becomes mission-critical.

Here’s a list of the 10 best tax consulting firms this year (in no particular order).

Deloitte is a global leader in tax consulting and advises multinationals on OECD Pillar Two from assessment through operational execution, with teams that map data requirements, standardize source inputs, and help build repeatable workflows for ongoing compliance. The firm’s global footprint and sector depth mean policy analysis and process design can be coordinated across dozens of jurisdictions rather than reinvented market by market.

A centerpiece is Deloitte’s Pillar Two Agent, a cloud platform that runs end to end: data collection, validation, calculation, and filing/reporting inside one environment. Deloitte positions it to add transparency to the close and compliance cycles by centralizing artifacts and status, which helps tax leaders move from one-off projects to steady-state operations.

Key highlights

PwC combines policy monitoring with delivery tooling so in-house teams can focus and execute on firm timelines. The Pillar Two Country Tracker gives tax leaders a current view of implementation status across jurisdictions, which is useful for sequencing readiness work and anticipating data asks from different authorities. PwC then links this monitoring to modeling and workflow so that insights translate into concrete steps.

On the execution side, PwC’s Pillar Two Engine models exposures and computes top-up obligations aligned to local rules, while Sightline provides a collaborative workspace for reporting, documents, and engagement workflows. This stack is designed to move clients from tracking rules to generating filings and managing ongoing operations in a single environment.

Key highlights

EY’s tax practice blends advisory coverage (indirect tax, mobility, TP, controversy) with products aimed at Pillar Two reporting mechanics. The EY GloBE Technology Suite addresses data collection, modeling, and reporting under BEPS 2.0, giving multinationals a structure to move from diagnostic to repeatable compliance. Documentation emphasizes handling new data granularity and cross-system reconciliations that Pillar Two introduces.

EY is also piloting AI-assisted workflows in tax. EY.ai for tax, built with IBM watsonx, targets data ingestion and task automation so consultants and in-house teams can spend more time on judgment and less on assembly. While maturity and use cases will vary by client, this direction signals an emphasis on using GenAI to reduce cycle time in data-heavy tasks.

Key highlights

KPMG anchors its delivery in the Digital Gateway for Tax, a cloud hub that centralizes access to the firm’s tax technologies, services, and insights. For Pillar Two, KPMG typically pairs readiness and data consolidation efforts with calculation/reporting workflows, offering a mix of managed services and platform capabilities so clients can scale from pilot to steady state.

The firm is also investing in AI infrastructure that underpins its platforms (including Digital Gateway), positioning multi-agent tooling as a way to improve speed and coordination across tax, audit, and advisory. For tax leaders, the practical benefit is a single entry point to KPMG tools plus a services model that accommodates both enterprise and upper mid-market needs.

Key highlights

Forvis Mazars unites U.S. and European capabilities under one brand, quickly moving into the global top tier after its formation in 2024 via the union of Forvis and Mazars. Its Pillar Two hub offers explainers, calculators, and updates that help teams plan data, process, and reporting tasks under GloBE.

The firm supports groups that report under both U.S. SEC and EU regimes, coordinating minimum-tax, transfer pricing, e-invoicing, and multi-country compliance. A single engagement team can align U.S. and EU workstreams to reduce rework.

Key highlights

Baker Tilly blends U.S. national expertise with a global network in 140+ countries, publishing regular guidance on Pillar Two and U.S. reforms. That combination helps clients coordinate domestic and international requirements without duplicating effort.

Service coverage spans international tax planning, cross-border structuring, M&A tax, and indirect tax compliance. The networked model supports multi-state and overseas filings at a cost structure that suits mid-market groups scaling internationally.

Key highlights

Grant Thornton emphasizes Tax Technology & Transformation (TTT) — a structured approach to modernizing tax processes and extracting value from new tools. The framework spans system selection, implementation, and optimization, with a focus on embedding automation and AI into everyday compliance and advisory workflows.

For clients balancing innovation with practicality, the firm pairs process redesign with enablement so in-house teams can operate the solutions they deploy. Coverage includes indirect tax optimization, international structuring, M&A tax, and dispute resolution for mid-market enterprises and multinationals.

Key highlights

Crowe publishes AI-readiness guidance for tax departments and ties it to digital reporting mandates. The focus is on identifying use cases, establishing responsible-AI guardrails, and linking tax modernization to broader finance workflows.

Beyond strategy, Crowe advises on indirect tax, e-reporting builds, transfer pricing, and GAAP-to-tax convergence. Sector experience in technology, healthcare, and manufacturing helps translate regulatory requirements into workable designs.

Key highlights

BDO focuses on scalable delivery for mid-market and growth companies, supported by a global network for cross-border issues. Its Global Tax Outlook program captures executive priorities each year and informs service development across international tax, indirect tax compliance, and emerging requirements like Pillar Two — useful for clients that want offerings shaped by current market pain points.

Engagements often emphasize practical frameworks and faster deployment rather than bespoke builds, which fits mid-sized groups adding entities or entering new markets. For finance leaders, the appeal is a balance of cost control with enough technical depth to handle digital reporting and minimum tax obligations as rules evolve.

Key highlights

RSM serves middle-market multinationals that need practical enablement as rules evolve. Its Navigating Business Globally series breaks complex frameworks — Pillar Two included — into operational steps that lean teams can execute.

Engagements typically combine GloBE calculations with ERP/tax data mapping and lightweight templates designed for ongoing use. The model aims to build internal capability so clients can refresh analyses independently, supported by RSM’s country teams where needed.

Key highlights

Choosing a tax consulting partner starts with finding the right fit. Map your footprint, risk areas, and timelines, then evaluate firms on how well they match that reality — sector depth, geographic coverage, and working tech that actually plugs into your stack. With that context, use the criteria below to separate a good pitch from a dependable operating partner.

Match the firm to your tax profile. A pharma group juggling R&D credits and transfer pricing needs a different playbook than a SaaS scale-up navigating nexus and digital reporting. Ask for references and case studies that mirror your footprint; generic claims rarely help in an audit room.

Map your revenue and entity footprint first. If you operate in 40+ countries, a single global program for Pillar Two and e-invoicing can reduce risk and coordination cost. If your exposure sits in 5–10 jurisdictions, a strong regional player often wins on speed, price, and local relationships.

Validate claims with a proof-of-concept. Ask the firm to pull ERP data, refresh a Pillar Two exposure, and produce a verifiable audit log in a short window. Momentum during onboarding is a reliable signal that the tooling is ready for production.

Get these three calls right, and you should find yourself in good hands that simplify your tax challenges.

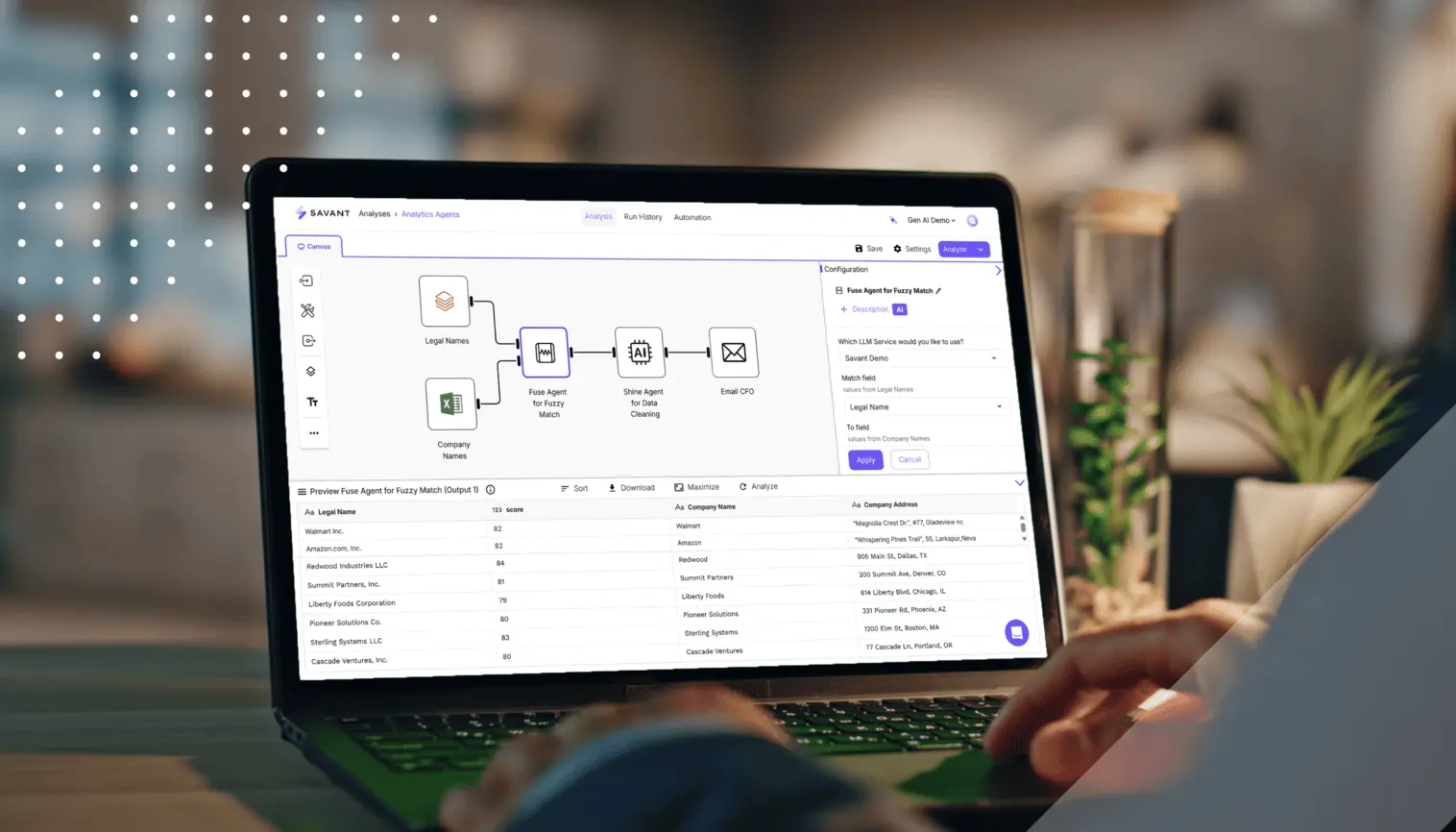

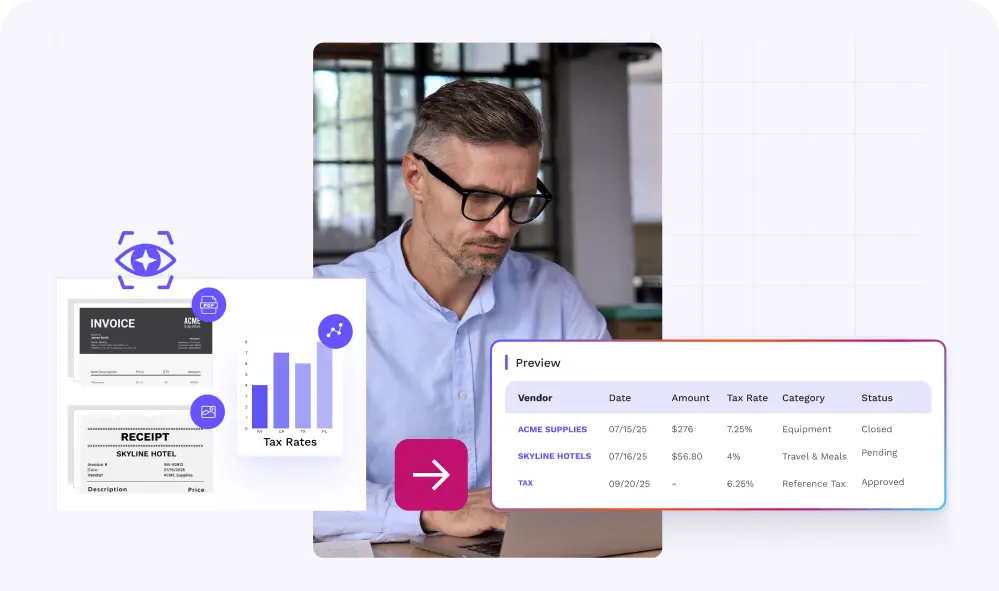

Savant is a cloud-native finance automation platform that helps tax teams run repeatable workflows with fewer handoffs and cleaner evidence. It connects to ERPs, payroll, expense systems, and data warehouses; orchestrates task flow end to end; and preserves an audit-ready trail as work happens.

Tax now runs in near real time. Rules change mid-quarter, filing windows compress, and digital reporting requires fast, accurate responses. The right consulting partner operates in the same rhythm as your finance systems, anticipating changes, aligning data, and keeping workflows moving.

The firms profiled here point to a broader shift: compliance is one output, control is the aim. Choose a partner that helps you act early and clearly, with evidence that stands up to scrutiny. In a real-time tax environment, calm becomes a competitive advantage.