About Rover

Rover is the world’s largest online marketplace for pet care, connecting millions of pet owners with trusted sitters and walkers across 17 countries. With high transaction volumes and complex compliance needs, Rover’s tax and accounting teams rely on data to ensure accuracy, efficiency, and auditability at scale.

The Challenges

Sales Tax Reconciliation Was Time-Intensive and Risk-Prone

The tax team managed high-volume transaction data across Stripe, Avalara, NetSuite, and Mode. Every month, they manually pulled reports, aligned records in Excel, and reconciled taxes using fragile formulas. Even minor mismatches triggered hours of back-and-forth checks.

Month-End Close Lacked Consistency and Auditability

Each cycle meant rebuilding the same logic. Address mismatches, rounding errors, and partial payments added complexity. Without a source-of-truth workflow or audit trail, compliance reviews were time-consuming and inconsistent.

Data Access Was Siloed and Manual

Only a few users could query Mode or access NetSuite reporting tools. Most relied on exports, creating version confusion and dependency. Analysts without SQL or admin rights couldn’t validate data or move quickly.

Limited Oversight of Sensitive Financial Data

Sensitive tax fields lived in spreadsheets and shared folders. There were no controls over who could view or edit critical data. During audits, proving how numbers were generated meant retracing disconnected steps manually.

The Solution

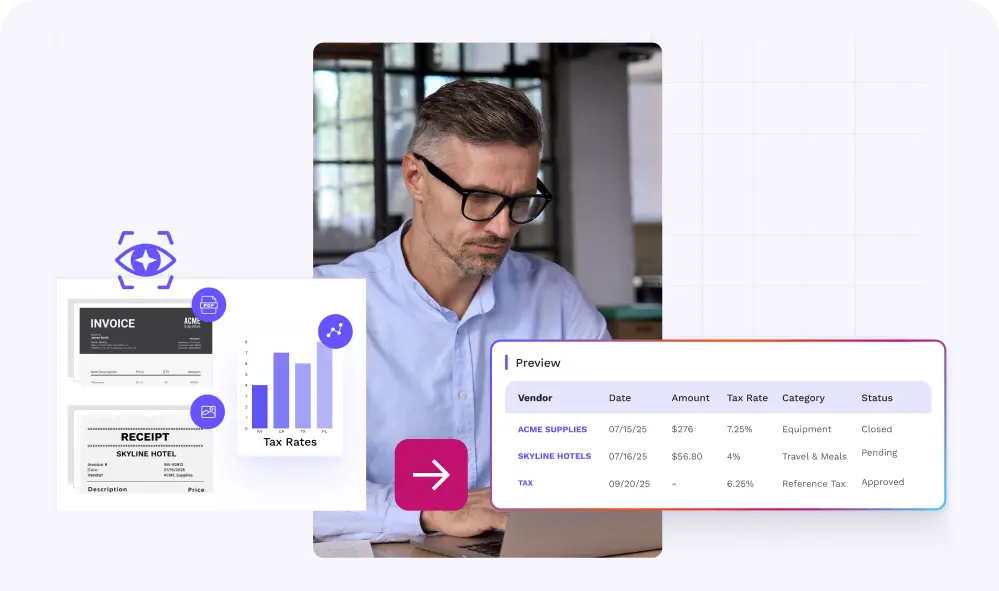

Automated, Reproducible Tax Reconciliation Workflows

Rover automated extraction of tax-relevant data from NetSuite, Stripe, and Avalara. Reconciliation logic, once trapped in Excel, was rebuilt as automated workflows that handled joins, rounding, and mismatches. Every output was consistent, traceable, and audit-ready. As tax rules shifted, the team could adjust logic directly in the workflow builder — no rework, no reformatting.

Self-Service Workflow Building

Finance teams created and maintained workflows with Savant’s drag-and-drop workflow builder — no Excel, no SQL, no macros. Even complex use cases, such as split payments or address normalization, were handled by built-in AI agents. Scheduled runs eliminate manual intervention.

Audit Trail and Centralized Governance

Savant gave Rover complete control over sensitive data. Workspaces were partitioned by team. Role-based permissions restrict field access. Every run was versioned and logged — ready for audits without rework.

A Closed-Loop Tax Workflow With Zero Gaps

Savant now powers Rover’s full tax cycle — from pulling data across systems to reconciling it and delivering clean, audit-ready outputs back into NetSuite. No CSVs. No logins. Just one governed, end-to-end workflow on a schedule.